| 1. | in rule 3, – in sub-rule (2), (i) in clause (c), for the word “ineligible”, the word “eligible” shall be substituted; | All the partners or directors, as the case may be, are not ineligible eligible under clauses (c), (d), (e),2[(f)], (g), (h), (i), (j) and (k) of sub-rule (1); | Self explanatory |

| 2. | (ii) after clause (e), the following clause shall be inserted, namely:- “(f) it is not a member of a registered valuers organisation: Provided that it shall not be a member of more than one such registered valuers organisation at a given point of time: Provided further that the partnership entity or company, already registered as valuers, on the date of commencement of the Companies (Registered Valuers and Valuation) Amendment Rules, 2022, shall comply within six months of such commencement with the conditions specified under this clause.”. | “(f) it is not a member of a registered valuers organisation: Provided that it shall not be a member of more than one such registered valuers organisation at a given point of time: Provided further that the partnership entity or company, already registered as valuers, on the date of commencement of the Companies (Registered Valuers and Valuation) Amendment Rules, 2022, shall comply within six months of such commencement with the conditions specified under this clause.”. | With this amendment, one more criteria has been added under non-eligibility to be a registered valuer. The new criteria says any partnership entity or company shall not be eligible it is not a member of a registered valuer organization or if it is member of more than one such registered valuer organization or it is already registered as valuers. |

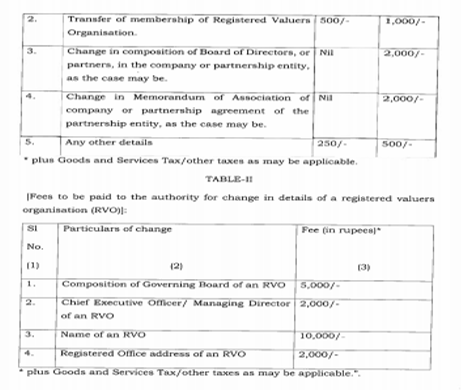

| 3. | In the said rules, after rule 7, the following rule shall be inserted, namely:- “7A. Intimation of changes in personal details etc., by registered valuer to authority. – A registered valuer shall intimate the authority for change in the personal details, or any modification in the composition of partners or directors, or any modification in any clause of the partnership agreement or Memorandum of Association, which may affect registration of registered valuer, after paying fee as per the Table -I in Annexure V.”. | “7A. Intimation of changes in personal details etc., by registered valuer to authority. – A registered valuer shall intimate the authority for change in the personal details, or any modification in the composition of partners or directors, or any modification in any clause of the partnership agreement or Memorandum of Association, which may affect registration of registered valuer, after paying fee as per the Table -I in Annexure V.”. | With this amendment, one more condition has been added for registration as registered valuer which is that a registered valuer shall intimate the authority for any change in the personal details, or any modification in the composition of partners or directors clause of the partnership agreement or Memorandum of Association, which may affect registration of registered valuer, after paying fee as per the Table -I in Annexure V. |

| 4. | In the said rules, in rule 8, in the proviso, in clause (a), for the word, “standards;”, the words, “standards; or” shall be substituted. | 8(1) The registered valuer shall, while conducting a valuation, comply with the valuation standards as notified or modified under rule 18: Provided that until the valuation standards are notified or modified by the Central Government, a valuer shall make valuations as per- (a) internationally accepted valuation standards; or (b) valuation standards adopted by any registered valuers organisation. | With this amendment, MCA has inserted word “or” which results in conducting valuation in any of the following standard : (a) internationally accepted valuation standards; or (b) valuation standards adopted by any registered valuers organisation. |

| 5. | In the said rules, after rule 14, the following rule shall be inserted, namely:- “14A. Intimation of changes in composition of governing board, etc. by the registered valuers organisations to the authority.- A registered valuers organisation shall intimate the authority for change in composition of its governing board, or its committees or appellate panel, or other details, after payment of fee as per the Table II in Annexure V.”. | “14A. Intimation of changes in composition of governing board, etc. by the registered valuers organisations to the authority.- A registered valuers organisation shall intimate the authority for change in composition of its governing board, or its committees or appellate panel, or other details, after payment of fee as per the Table II in Annexure V.”. | With this amendment, ROC has added one more condition in recognition of registered valuer organization by adding sub-rule that a registered valuers organization shall intimate the authority for change in composition of its governing board, or its committees or appellate panel, or other details, after payment of fee as per the Table II in Annexure V. |

| 6. | In the said rules, in Annexure-III, in Part II, in serial number XI, relating to SURRENDER OF MEMBERSHIP AND EXPULSION FROM MEMBERSHIP, in clause 26, in sub-clause (1), in item (b), the following Explanation shall be inserted, namely:- “Explanation.– For the removal of doubts, it is hereby clarified that a member functioning as a whole time director in the company registered as valuer shall not be treated as taking up employment for the purpose of this provision.”. | (1) A member shall make an application for temporary surrender of his membership of the Organisation at least thirty days before he- (a) becomes a person not resident in India; (b) takes up employment; or “Explanation.– For the removal of doubts, it is hereby clarified that a member functioning as a whole time director in the company registered as valuer shall not be treated as taking up employment for the purpose of this provision.”. (c) starts any business, except as specifically permitted under the Code of Conduct; and upon acceptance of such temporary surrender and on completion of thirty days from the date of application for temporary surrender, the name of the member shall be temporarily struck from the registers of the Organisation, and the same shall be intimated to the authority. | With this amendment, ROC has provided an explanation under condition form surrender of membership and expulsion from membership in clause 26, in sub-clause (1), in item (b) which a member shall make an application for temporary surrender of his membership of the Organisation at least thirty days before he takes up employment. Here, for the removal of doubts, it is hereby clarified that a member functioning as a whole time director in the company registered as valuer shall not be treated as taking up employment for the purpose of this provision |