SEBI vide its Circular dated November 10, 2022 made amendment to Chapter – XX (Bank account details for payment of fees) of the NCS Operational Circular dated 10th August, 2021.

Chapter XX of the Operational Circular dated 10th August, 2021 (NCS Operational Circular), regarding ‘Bank account details for payment of fees’, inter alia, provides the procedure to be followed for payment of fees, as applicable. Further, SEBI vide circular 18th dated July, 2022 informed that 18% of GST will be levied on the fees payable to SEBI.

Accordingly, the following amendment is being made to Chapter -XX (Bank account details for payment of fees) of the NCS Operational Circular :

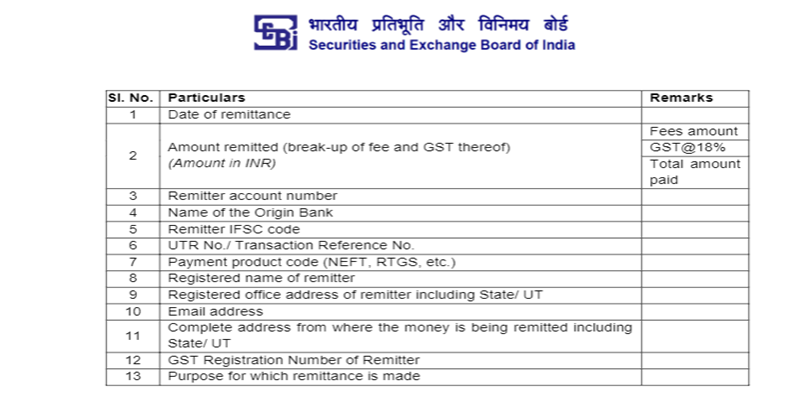

Paragraph b of the said chapter shall be replaced with the following:

“Provide the remittance particulars by email at od-ddhs@sebi.gov.in, immediately after the remittance is made, in the following format:

The provisions of this circular shall come into force with immediate effect and is applicable to all Issuers who have listed and/ or propose to list Non-convertible Securities, Securitised Debt Instruments, Security Receipts or Commercial Paper; Registered Merchant Bankers; and Recognised Stock Exchanges.