SEBI, vide its circular dated November 24, 2022 came out with a format for reporting of OTC trades in non-convertible securities shall be made by all person(s) dealing in such securities by replacing paragraph 1.3 of Chapter XVI, titled, “Reporting of Trades”, of the Operational Circular dated August 10, 2021.

SEBI, vide Operational Circular No. SEBI/HO/DDHS/P/CIR/2021/613 dated August 10, 2021(as amended from time to time), has prescribed the requirements pertaining to operational and other aspects relating to the issue and listing of Non-convertible Securities. In the said Operational Circular, Chapter XV Ion ‘Reporting of Trades’, inter alia, contains provisions relating to reporting, clearing and settlement of OTC trades by all person(s) dealing in non-convertible securities.

It is observed that information on OTC trades in listed Non-convertible Securities provided to the Stock Exchange(s) by the investors is incomplete and/ or inaccurate. This, in turn, amounts to incorrect and distorted information being displayed on the Stock Exchanges’ websites. In order to address the issue, it has been decided all OTC trades shall be reported in a uniform format specified in (3) below.

| Sr. No. | Part/Regulation/ Chapter/Section /Sub-section(s) | Under Old Regulation | Under New Regulation | Comment |

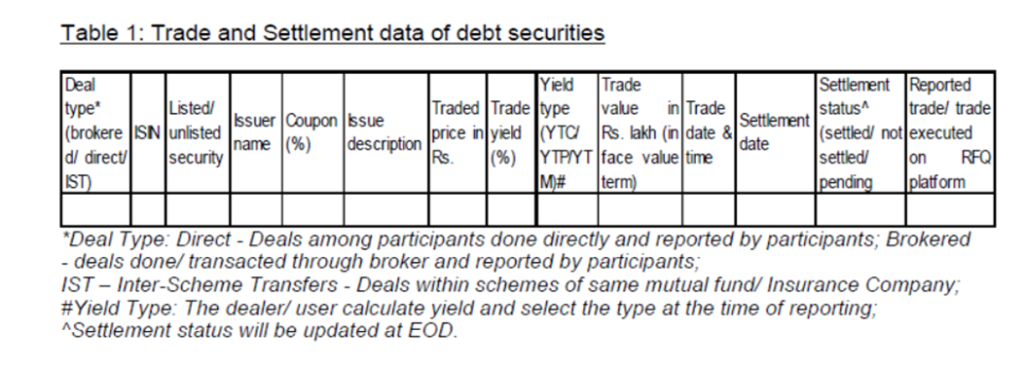

| 1. | paragraph 1.3 of Chapter XVI, titled, “Reporting of Trades”, of the Operational Circular shall be replaced as follows: | The reporting of trades in non-convertible securities shall be made by all person(s) dealing in such securities irrespective of whether they are SEBI registered intermediaries or otherwise. | “1.3. The reporting of OTC trades in non-convertible securities shall be made by all person(s) dealing in such securities irrespective of whether they are SEBI registered intermediaries or otherwise, as per below mentioned format: | With this amendment, now reporting of OTC trades in non-convertible securities shall be made in format as provided by SEBI along with this circular. |

Format for reporting of OTC trades in non-convertible securities shall be made by all person(s) dealing in such :

Further, Stock Exchanges shall monitor the compliance of this circular / chapter XVI of the Operational circular and bring to the notice of SEBI, periodically, discrepancies in reporting of OTC trades by investors.

The provisions of this circular shall come into force from January 01, 2023 and is applicable to all Entities buying, selling, trading or otherwise dealing in listed Non-convertible Securities.