SEBI vide its Circular dated November 30, 2022 reduced timelines for listing of debt securities issued on a private placement basis to three days which at present is four days. SEBI added that the reduction has been made in order to bring about efficacy in the listing process and to expedite the availability of securities for trading by the investors.

Further, in order to bring about clarity and standardization in the process of issuance and listing of such securities, on private placement basis, a list of the steps involved, pre-listing and post-listing, and relevant timelines have been detailed, both through Electronic Book Provider (EBP) platform and otherwise.

The above changes have been brought about by SEBI on the basis of the feedback received from market participants to standardise the pre-listing processes and revise the time gap between credit confirmation and ISIN activation. This will help to bring about efficiency in the market.

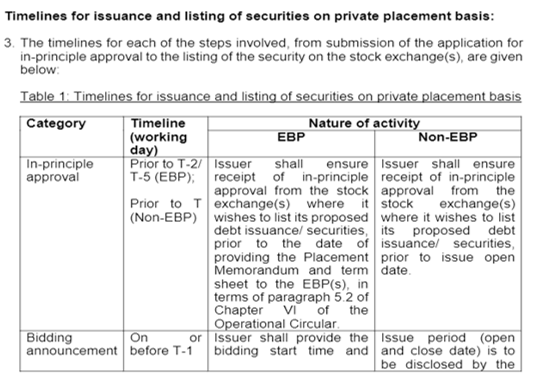

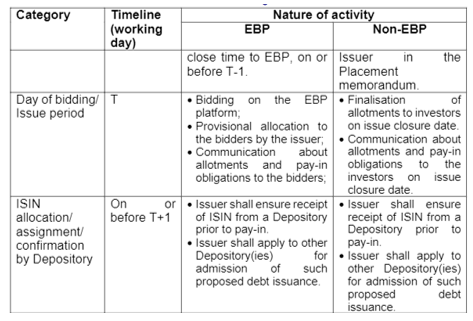

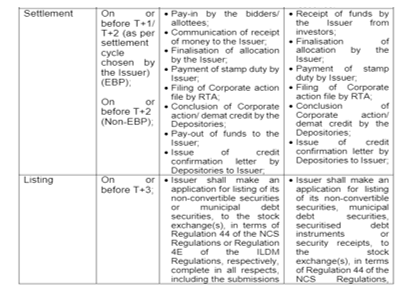

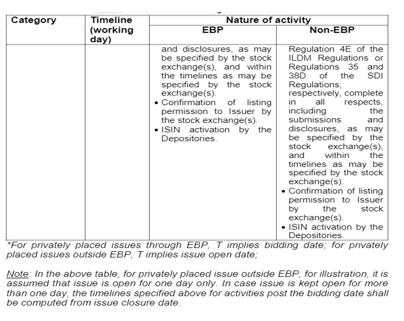

| The timelines for each of the steps involved, from submission of the application for in-principle approval to the listing of the security on the stock exchange(s), are given below (In detailed timelines as per Annexure I): |

| In-principle approval – Prior to T-2/ T-5 (EBP); Prior to T (Non-EBP) Bidding announcement – On or before T-1 Day of bidding/ Issue period – T ISIN allocation/ assignment/ confirmation by Depository – On or before T+1 Settlement – On or before T+1/ T+2 (as per settlement cycle chosen by the Issuer)(EBP); On or before T+2(Non-EBP); Listing – On or before T+3; |

Stock Exchanges shall inform the listing approval details to the Depositories whenever the listing permission is granted to securities issued on private placement basis.

Depositories shall activate the ISIN only after the stock exchange has given approval for listing.

In case of delay in listing beyond the timelines specified, the issuer shall pay penal interest of 1% p.a. over the coupon/dividend rate for the period of delay to the investor.

The provisions of this circular shall come into effect from January 1, 2023 and is applicable to all Issuers who have listed and/ or propose to list Non-convertible Securities, Securitised Debt Instruments, Security Receipts or Municipal Debt Securities; Recognised Stock Exchanges; Registered Depositories; Registered Credit Rating Agencies, Debenture Trustees, Depository Participants, Stock Brokers, Merchant Bankers, Registrars to an Issue and Share Transfer Agents, Bankers to an Issue; Sponsor Banks; and Self-Certified Syndicate Banks

Annexure I: